S/4HANA INTELLIGENT FINANCE - TREASURY AND CASH MANAGEMENT

Reduce your treasury and cash management costs by up to 20%

Due to a volatile market environment, the financial crisis and Covid19 pandemic have shown that sound management of corporate finances is essential. What is more, with negative interest rates and short-term liquidity management, the importance of treasury and cash management has increased. In order to take this into account, we help you to optimize your treasury and make it fit for your "intelligent, agile, future-oriented company".

The treasury processes accompany your company across the entire end-to-end process chain - whether order-2-cash or purchase-2-pay. In this way, the information from customer orders and orders flows into the future liquidity level of your company and you can identify any bottlenecks or surpluses at an early stage, which you manage with the Transaction Manager and ensure communication with the dealers (banks) as well as internally.

On the basis of all financial transactions in your company, you can not only trigger the necessary automated documents in the financial accounting, carry out evaluations according to IFRS, accruals, etc., but also carry out a comprehensive risk assessment.

- How much market risk is there in these transactions (exchange rate, interest rates, etc.)?

- How much risk of default does the issuer of the paper you have purchased have?

If you have exceeded or fallen below the set thresholds, necessary measures are derived to reduce your financial risk. At the same time, you meet your reporting obligations according to EMIR and MIFID II.

Source: SAP

The Transaction Management:

The central content of many finance departments is the management of financial transactions. Depending on the company organization, a more inward-looking service for the affiliated group companies can be in the foreground, or active action on the financial markets for investing liquid funds, financing planned investments or hedging existing risks. For this purpose, the Transaction Manager offers the tools to process the related financial transactions from the entry to the transfer of the relevant data to the financial accounting. This has the advantage that all types of business - from short-term financing to strategic investments - are carried out on the same platform.

The Market Risk Analyzer:

In addition to traditional financial management tasks such as financial disposition, securing and controlling liquidity, controlling market risk as a factor in a company's competitiveness plays a decisive role. Here the Market Risk Analyzer offers comprehensive inventory evaluations such as mark-to-market evaluations of financial transactions. In addition, risk and performance indicators such as exposure, future value, sensitivities and value-at-risk can be determined. In addition to contracted positions, fictitious financial transactions can also be included in the reporting of these metrics. The evaluations can be based on both real (see Integration with Market Rates Management) and simulated market prices. Together with a high degree of flexibility in the design of the reports, the Market Risk Analyzer thus provides a reliable evaluation basis for market risk controlling.

Credit Risk Analyzer:

The focus of the Credit Risk Analyzer is on the measurement, analysis and control of default risks. First and foremost, it is about covering the specific risks for a company's financial operations. In order to carry out active controlling here, the Credit Risk Analyzer includes risk control using limit specifications and flexible limit management with online monitoring as well as extensive reporting. In this way, the functionaries in the company can avoid default risks at the point in time they arise in advance, identify them at an early stage and take countermeasures.

Portfolio Analyzer:

Investments are characterized by the fact that diverse investment alternatives compete for the available funds. The question of the economic success of an investment is particularly important. The Portfolio Analyzer is designed to give you answers to exactly this question. The focus is on the analysis of the performance, as well as the comparison with the desired achievement of goals. Flexible and diverse evaluation options help you to get an overview depending on the portfolio structure, hierarchies and asset categories.

Market Rates Management:

Market Rates Management is a flexible and preconfigured solution to automatically transfer various market data from the various data providers (e.g. refinitive) into your SAP system. This data is then the starting point for the management of your financial transactions.

In-house Cash:

With In-House Cash you can optimize your internal and external payments. This enables you to reduce the number of bank accounts in the group and, subsequently, the number of international transfers - and thus make a significant contribution to reducing bank charges and expenses. The in-house cash center acts as your internal virtual bank, with which the subsidiaries maintain current accounts.

Bank Communication Management:

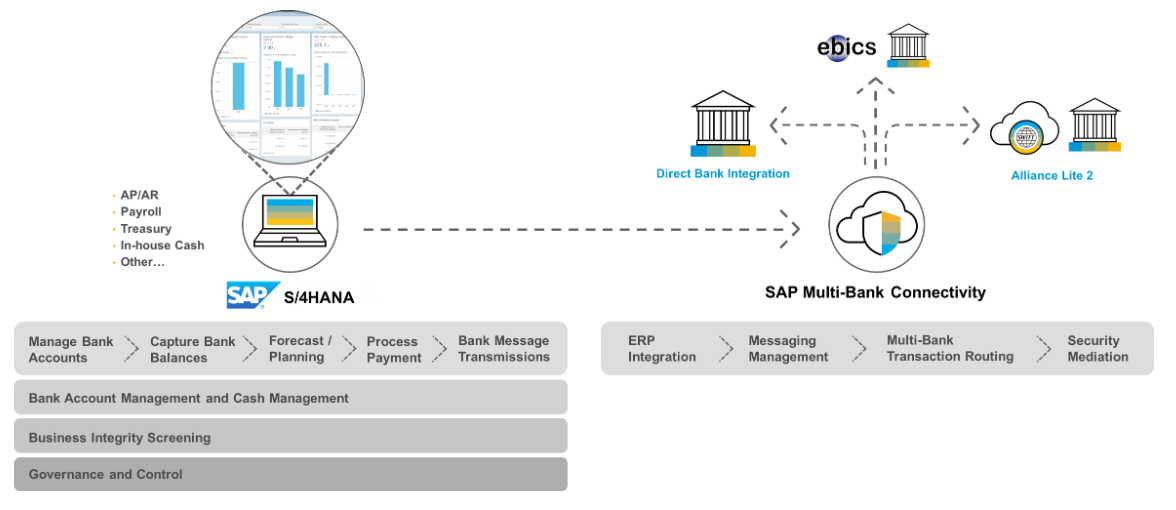

The SAP Bank Communication Management is used to manage direct interfaces for communication with banks. This means that you can transfer incoming (account statement) and outgoing (payment media) payment media directly from or to the bank computer and manage this in the payment status monitor. You can also use an approval workflow to approve payments on the move (FIORI) and sign them digitally.

Multi Bank Connectivity:

Building on Bank Communication Management, you can connect banks and other financial institutions (using different format types) to your SAP system via your own secure network, which is hosted and maintained by SAP. This accelerates bank communication and supports you in connecting your global branches. Alternatively, there is the possibility of communicating with the bank computers using the appropriate connectors (EBICS, SWIFT, H2H).

Cash and Liquidity Management:

The Cash and Liquidity Management, which is new under S / 4HANA, offers you extensive options for entering and managing your bank accounts. Here you can not only store your own limits and approval logics, but also define special workflows. The central content is the merging of the liquidity data with the cash flow data, which enables forward-looking statements on the origin and use of funds in a structured and real-time integrated form. Your tool for this is the cash flow analyzer, which is also available on FIORI.

Cash Pooling:

Closely linked to cash management, the clearing of accounts helps you to transfer amounts from your bank accounts to a central bank account. You can always see very clearly which amounts are available in which accounts or where there is a shortfall that needs to be serviced. Payment instructions are created from this structured representation, which in turn are passed on directly to your banks for execution - possibly even without separate approval. This ensures that your liquid funds are optimally allocated, regardless of whether there are positive or negative interest rates.

Trade Repository Reporting:

As part of the regulation of the financial markets, companies must report their derivative financial transactions to a trade repository (EMIR). The trade repository reporting functions support you in the process of generating trade repository reports. After all the checks and approvals, your trade repository messages are ready for transfer to a trade repository. You can also read and process incoming messages from the register via this channel.