S/4HANA INTELLIGENT FINANCE - PREDICTIVE ACCOUNTING

Predictive Accounting in SAP S/4HANA – the crystal ball for your financial performance

Today, financial performance is critical to a company's success, so stakeholders expect financial forecasts with unprecedented accuracy and detail. Wouldn't it be fantastic if you could use an intelligent ERP solution to reliably and transparently forecast your company's financial performance? And all this without prior data extraction?

With the help of intelligent SAP S/4HANA, the former vision of the future has long since become reality. Based on a comprehensive document journal, the latest technology provides you with unprecedented transparency for your financial performance - not only for historical data, but also for future-related data. With SAP S/4HANA, you run fine-grained simulations of your business processes and analyze your predicted postings just like your real-time data. In this way, you can identify predicted exceptions and opportunities in advance and take appropriate action. You can also use predictive accounting functionality to analyze exactly how incoming orders or currency fluctuations in forecasted revenues will affect your company's financial performance. Please find below a brief description of the basic concept of predictive accounting in SAP S/4HANA as well as what is necessary to be able to use these innovations in a way that optimizes success.

Source: SAP

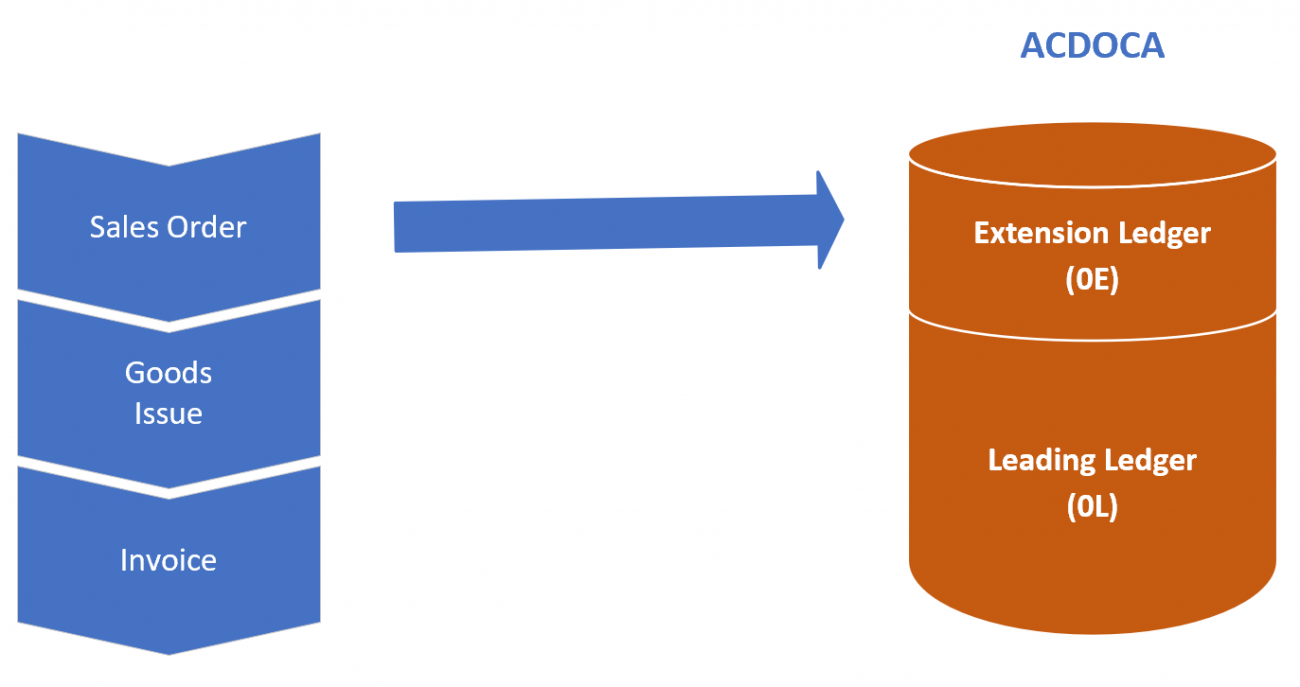

Before we dive deeper, let's look at the two core innovations that bring this to life: First, a comprehensive journal in which all entries - such as expenses or income - are stored in a common place.

The big advantage here is that you can jump directly from the profit and loss statement or the balance sheet to the general ledger and view the corresponding documents.

The second pillar is the concept of the enhancement ledger, the so-called forecast ledger. This is a special sub-ledger in which the forecast results are stored structurally in the same way as the historical actual data. This allows all financial processes to be performed not only with real-time data, but also with future data - based on current financial data. This allows you to conveniently predict how your financial results will develop at the end of the current financial period or quarter and understand the reasons behind it.

What would it take to use these innovations for my business?

When a sales order is created, predictive accounting simulates the goods issue as well as the invoice and triggers subsequent financial processes, such as cost of sales allocation. The results of the simulation are stored as posting documents in the predictive ledger. In the "View Balance Sheet/P&L" app, you can easily identify the corresponding documents using a prefix in front of the document ID. Later, when goods receipt and invoicing have actually taken place, the simulated postings are reversed and the actual documents for goods receipt and invoice are posted.

There are two analytical apps in SAP S/4HANA for predictive accounting:

- 'Sales Order Entry - Predictive Accounting' you can analyze your incoming orders by looking at your predicted postings from different angles and levels of detail. You can analyze predicted revenue, cost of sales and margins based on time periods and various organization, accounts receivable, product and accounting attributes. From the app's list display, you can jump directly to general ledger documents, sales orders, customers, and products. If you want to make sure that your company is meeting the expectations of the financial world and achieving its set financial goals, this allows you to identify orders that are particularly important from a revenue perspective and immediately take the necessary action.

- The second app, 'Gross Margin - Assumed/Actual', allows you to view and analyze forecasted, actual and planned revenue, cost of sales, margin and sales deductions based on sales orders side-by-side in direct comparison. Furthermore, you can filter by time periods and different attributes, e.g. by customer, product and profit center.

The added value of predictive accounting is therefore basically in the consideration of future payment and revenue streams for your company! This allows you to manage and control your company more precisely and in a more targeted manner.