S/4HANA INTELLIGENT FINANCE - ORDER TO CASH

Reduce the risk of financial default and optimize business relationships with efficient receivables and credit management

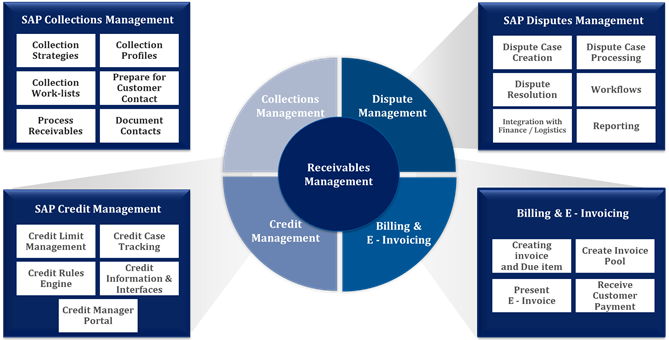

The creditworthiness and payment behavior of your business partners have a direct impact on your company's business results. Improve your receivables process with SAP Dispute and Collections Management and SAP Credit Management. You will significantly reduce the workload for your debt collection, thus shortening the time your receivables are outstanding and improving customer service!

Source: SAP

SAP Credit Management supports your company with bad debt risk. It determines the default risk of the receivables from your business partners at an early stage, allowing credit decisions to be made efficiently and partially automatically. Thanks to a system-independent XML interface, external systems can also be connected.

With SAP Credit Management, you can operate a central credit management system. Connected applications (e.g. Sales and Distribution, Logistics Execution, Financial Accounting) report the line item commitment of a business partner These reports are then consolidated in Credit Management to form the commitment and checked against the current credit limit of the business partner. Together with the credit limit check, you can perform additional checks such as the oldest open item, the maximum dunning level, or the date of the last payment.

The business partner solution is integrated in the new Credit Management and provides workflows for processing credit limit applications. Evaluations can be carried out conveniently via Fiori Apps, and credit decisions are documented automatically. In addition, repeated credit checks are possible and tools are also available to perform mass updates of the business partner's score and mass changes to credit limits.

Credit master data for business partners

Credit master data includes the current credit limit, one or more externally determined credit scores, and the risk class. In SAP Credit Management, you can also include the collateral stored for a business partner in the calculation of the exposure, so that monitoring of your own risk is also guaranteed.

Credit information and business partner rating

SAP Credit Management enables the person responsible to determine and manage both external and internal credit information for a business partner.

Creditworthiness and Credit Limit Determination and Credit Limit Check (Credit Rules Engine)

Allows to automate certain processes with the help of rules:

- Credit rating of business partners

- Determination of credit limit

- Credit check rules

Credit information and credit decisions

SAP Credit Management supports you in making efficient credit decisions with the necessary credit information.

In business relationships, contentious business situations often arise in which business partners reduce open payment amounts or do not release them for payment. These reductions or changes were usually not agreed in the initial contract with the payee and therefore require time-consuming investigation, follow-up and resolution.

As a dispute case coordinator, the SAP Dispute Management component enables you to structure your investigations and distribute and manage the results for all stakeholders in your organization.

This is of particular interest to you if one or more of the following factors apply to your company:

- Numerous underpayments or disputed payments from customers.

- Long processing times for these cases

- High manual effort

- Complex corporate and communication structure

AR items in conflict are flagged as disputes and referred to as a clarification case. A clarification case is a detailed document that records the reason for a disputed item, the details of the follow up, and the various stages of communication. The clarification case can be created in several ways:

- In a specific transaction

- Via the customer line item display

- The dispute case creation can also be automated for scenarios such as underpayment or when the open item has reached a certain dunning level

When the dispute case is resolved, it is closed with an appropriate action. Many of the attributes for the dispute case can be created automatically. A dispute case can also capture the entire transaction history for all assigned disputed items. In addition, email notification can also be set up. Multiple open accounts receivable items can be assigned to a dispute case. Certain keys, such as planned closing date, processor and processing data can be filled in automatically.

To close the dispute case, the processor can decide to do this manually or automatically via the system. In customizing, we can jointly determine which procedure is chosen.

In summary, the introduction of an integrated collection and dispute resolution system in your company offers many advantages. You will improve the days sales outstanding (DSO) and thus improve cash in and working capital management (WCM). In addition, there are several other benefits such as savings in insurance premiums, interest costs, more efficient operations, higher customer satisfaction, freeing up resources for other tasks, and improved transparency and reporting.

Cash collection against due and overdue items has become a very important factor for most companies in the competitive global market.

SAP Collections Management supports you in your proactive receivables management. With the help of collection strategies, you can evaluate and prioritize customers from a receivables management perspective. Customers who meet rules defined in a strategy are distributed to worklists. Collection specialists in your organization can use these worklists as a basis for contacting customers in order of priority to collect outstanding receivables more quickly.

Collection management within SAP FSCM helps prioritize the customer receivables function according to defined rules. These established priorities can be used to set up and distribute collection work to collection specialists, who can then record a history of collection-related contacts with customers.