WORLDWIDE E-INVOICING

Transfer Tax Information with SAP Document Compliance

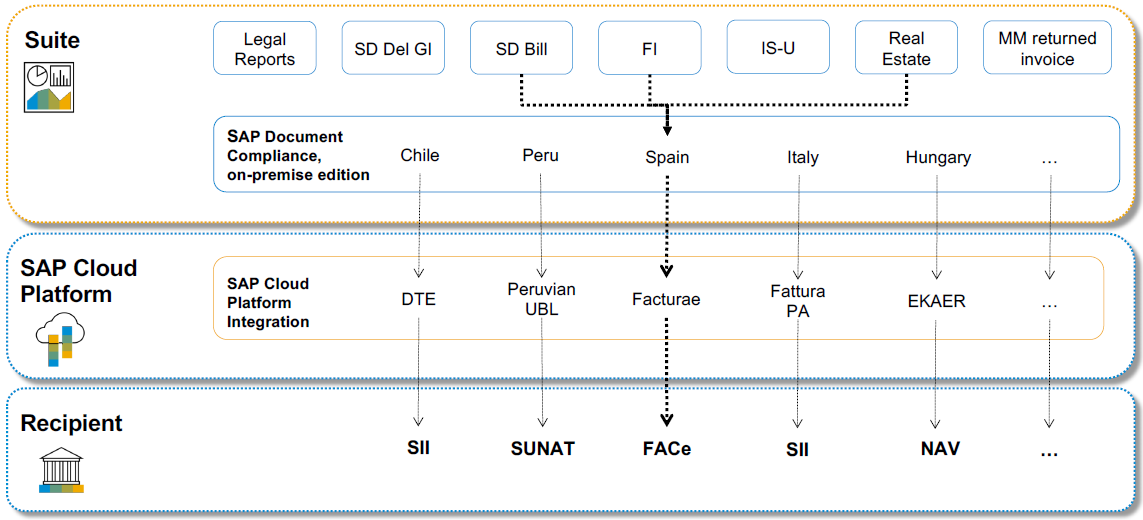

SAP Document Compliance is integrated in ECC and S/4HANA, and provides a solution for all mandatory countries such as Italy, Hungary and Turkey. Companies benefit from the uniform user experience and support from a single partner.

Countries like Italy, Hungary, Turkey, and many more require companies to issue tax information to legal authorities electronically. Data from outgoing and incoming business documents like delivery notes and invoices need to be transferred in a predefined format to external systems. In addition, every country has its own legal requirements of how data have to be structured and transferred.

In the most cases, this is an eDocument in XML file format with predefined fields. To bring the data from your ERP into the right structure and fields of the required XML file, SAP created “Document Compliance”, to simplify tax information transfer while complying with local regulations. The solution includes every process step of e-Invoicing, from eDocument generation to transfer, with all country-specific legal requirements. Additionally, the monitoring and managing of your submitted eDocuments in an overview cockpit makes it easy to keep on track on status and feedback from external systems.

- Chile

- Colombia

- Croatia

- Czech Republic

- France

- Hungary

- Italy

- Mexico

- Peru

- Slovenia

- Spain

- Taiwan

- Turkey